Who doesn’t look forward to that golden period – free from

work and family-related responsibilities? One has all the time to pursue own

passions. But to be able to lead a comfortable life post-retirement, one need

to have significant retirement corpus as well as a steady source of income

(pension).

Significance of Retirement Planning

- Inflation: Inflation reduces the

purchasing power of money over time. If inflation is 5%, then Rs 100 can

buy only Rs 95 worth of goods after 1 year. After 10 years, it can buy

only Rs 60 worth of goods and after 20 years, only Rs 37 worth of goods.

Your needs will remain the same but your money will be worth less and

less. In order to fight inflation, it is very important that your money

also grows over time. You need to plan for inflation.

- Rising

medical costs: With

advancing age, health related problems are a concern for senior citizens.

However, cost of quality private sector healthcare is increasing at a very

fast rate in India. Some studies show that inflation in the cost of

medical expenses is around 15% per annum. A serious illness can eat a big

part of your retirement savings and put you under considerable stress.

- Falling

interest rates: Senior

citizens traditionally rely on bank fixed deposit and government small savings

schemes for their regular cash-flows. Over the last 20 years, interest

rates of government small savings schemes have come down significantly. As

our economy (GDP) grows, money supply will also grow and interest rates

will come down even further. You need to save more and create a larger

corpus in order to generate sufficient income to meet your post retirement

expenses.

- No

pension: India

is largely an un-pensioned society. Private sector employees in India,

unlike western nations like United States or United Kingdom, do have not

have safety net in the form of a national pension programme. They need to

create their own post retirement income stream by saving and investing

systematically during their working lives. As such, retirement planning

should be one of your most important financial goals during your working

lives.

Benefits of planning your retirement with mutual funds?

While many of you

will be tempted to opt for a pension plan instead of mutual funds for your

post-retirement financial requirements, but the fact remains that mutual funds

are a safer and a better option. Here are the reasons you need to know while

choosing between mutual funds and pension plans.

Flexibility

Mutual funds are more

flexible than pension plans. There are no restrictions on making any partial or

entire withdrawal at any given point of time. If you feel, you can discontinue

your investment and change to another mutual fund as and when you like.

Tax

Efficient

Mutual Mutual funds

are more tax-efficient as compared to pension plans. Pension income is added to

your other incomes for taxation, and there is no exception. While in case of

equity mutual funds, long-term capital gains are tax-free up to Rs 1 lakh, and

in case of debt funds, it is levied after indexation, which most of the time

reduces the tax to nil.

Transparency

Mutual funds are more

transparent as compared to pension plans as you can easily access all the

information that you want regarding a mutual fund. Post-retirement life

requires you to have a stable source of income to be able to continue your

lifestyle. With the help of mutual funds, you can easily plan for a secure

future and minimise the risks involved.

A SIP FOR EACH GOAL

•

Every individual’s goals are unique - be it a dream vacation, a

new car, a bigger house, or retirement planning. When you set out to achieve

these goals, the monetary amounts, the time required, and the associated risks

are different for different purposes.

•

Different SIPs in suitable mutual funds could be started to match

your every need with what you can afford to invest. So, instead of approaching

your goals in the conventional linear way, you could work towards achieving

various objectives simultaneously by starting multiple SIPs.

•

For example, long-term goals can be achieved through SIPs in

equity oriented funds, whereas SIP could be started in suitable debt oriented

funds to plan for your short-term goals.

Systematic Investment

Plans

Mutual

fund systematic investment plan (SIP) is one of the best ways to invest for

retirement planning. Through SIP, you can invest in a mutual fund scheme of

your choice, based on your investment needs and risk appetite, from your

regular monthly savings through auto-debit from your savings bank account. SIP

can be a disciplined way of investing because it will make you control your

spending habits and invest regularly. SIPs in equity mutual fund schemes

also average the cost of your purchase (Rupee Cost Averaging) by

taking advantage of stock market volatility.

You

can start your SIPs with very small monthly (or any other intervals)

investments, as low as Rs 1,000. The longer your SIP tenure, the more wealth

you may create through the the power of compounding.

A young person has a long accumulation phase of 20-30 years where you should be regular and disciplined with your investments so that compounding can work for you. You have to be disciplined of not using that money elsewhere. During this phase, one should invest in equity as much as possible. If you go with mutual funds, you can have a 100 per cent equity allocation for the initial 15-20 years. And maybe then you can start with a re-balancing plan and have a 10-25 per cent fixed income allocation or with any other asset allocation that you want. You should be very aggressive during the accumulation phase.

One should be aggressive and invest as much as

possible in equity during the accumulation phase and once he retires, he may

follow a conservative plan with any of the above-mentioned allocations. But he

should ensure that he is investing some part of his corpus, 30-50 per cent in

equity and does not make an annual withdrawal of more than five per cent of the

corpus.

Mutual Funds for Retirement Planning

Mutual funds are ideal

for long-term financial planning. Early entrants are UTI and Franklin

Templeton, Reliance AMC. After solution oriented MFs were recognized as a

separate scheme classification by SEBI, more MFs has entered the field.

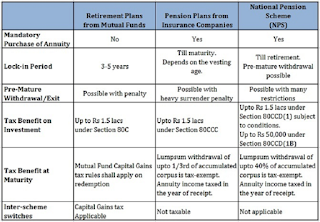

Comparison of features of different investment options for Retirement Planning

Comparison of MFs with NPS and Insurance plans

Comparison of Rate of Return from different options for Retirement Planning (Nov 2013)

Latest Rates ( Jan 2022)

The latest rates available on past returns for EPF, NPS, Endowment Plans, and MFs are given below after the future rates for PPF and small savings.

Public Provident Fund

The government has decided to keep the interest rates unchanged on small savings schemes or post office schemes for the January-March quarter of FY 2021-22. The Ministry of Finance made this announcement via a circular dated December 31, 2021

According to the circular, for the last quarter of FY 2021-22, the Public Provident Fund (PPF) will continue to earn 7.10 per cent. The Senior Citizens Savings Scheme (SCSS) will continue to earn 7.40 per cent, and post office time deposits will fetch 5.5-6.7 per cent. The interest rates will be applicable for the period January 1, 2021 to March 31, 2022.

Pradhan Mantri Vaya Vandana Yojana

Another product designed specifically for senior citizens, Pradhan Mantri Vaya Vandana Yojana (PMVVY) is offered by the Life Insurance Corporation of India (LIC). Like SCSS, you can invest up to Rs 15 lakh and it also promises a return of 7.4 percent. A government-backed scheme, it comes with no credit risk and a longer tenure of ten years, making it suitable for retirees. The scheme was to end on March 31, 2020, but the central government decided to extend until March 31, 2023 due to its popularity amongst retirees. However, the interest rate was slashed from 8 percent to 7.4 percent. Yet, it remains an attractive proposition for senior citizens, offering returns far higher than those of fixed deposits. For example, the State Bank of India’s (SBI) offers an interest of 6.5 percent to senior citizens for fixed deposits with tenures of 5-10 years.

Employees Provident Fund

The Employees’ Provident Fund (EPF) is a savings scheme for employees who are working for organisations that come under the Employees’ Provident Fund Organisation (EPFO).

· Employer and employee make contributions

· Interest rate is 7.1% p.a. for 1 October 2021 to 31 December 2021

· Wage ceiling is Rs.15,000

· Mandatory for organisations with over 20 employees

The EPFO decides the rate of interest for the EPF scheme on a yearly basis. The rate of interest is dependent on the market conditions and is vetted by the finance ministry. The interest rate can be calculated either by using the step method or the formula method. The rate of interest for the FY 2021-2022 is yet to be declared.

The 8.5% rate of interest on provident fund deposits for the last financial year was decided by the EPFO's apex decision making body Central Board of Trustees (CBT) headed by Labour Minister in March this year.

The rate of interest on EPF for 2020-21 has been ratified by the Ministry of Finance and now it would be credited into the accounts of over five crore subscribers. In March last year, the EPFO had lowered interest rate on provident fund deposits to a seven-year low of 8.5 % for 2019-20, from 8.65% in 2018-19.

Endowment Policy

Endowment policy are a type of life insurance policy, which provides the combined benefit of insurance coverage and savings. Endowment plan helps the insured to save regularly over a particular time period in order to avail a lump-sum amount at the maturity of the policy. The maturity amount is paid in case the insured survives the entire tenure of the policy. Rateof return is 6%

The National Pension Scheme

National Pension System (NPS) is a voluntary retirement savings scheme laid out to allow the subscribers to make defined contribution towards planned savings thereby securing the future in the form of Pension. It is an attempt towards a sustainable solution to the problem of providing adequate retirement income to every citizen of India.

At the time of normal exit from NPS, the subscribers may use the accumulated pension wealth under the scheme to purchase a life annuity from a PFRDA empaneled life insurance company apart from withdrawing a part of the accumulated pension wealth as lump-sum, if they choose so. PFRDA is the nodal agency for implementation and monitoring of NPS. NPS rate of return vary from category to category. But on an average it may be around 10-11%. More details can be had from https://npstrust.org.in/

Mutual Fund Pension Schemes

Though,

there is mandatory lock-in period of 5

years, main advantage of mutual funds’ solution oriented retirement products is

that you don’t have to buy an annuity, as is the case with the National Pension

Scheme (NPS) or pension plans from insurer. Instead, you can opt for a

systematic withdrawal plan to meet your regular cash flow needs on retirement.

The same holds true for children mutual fund products. These products

have been offering 10-12% on average in the long term.

Disclaimer

Mutual fund investments are subject to market risk. Read all scheme-related documents, terms and conditions carefully before investing. The above-mentioned information is purely informational. Consult your investment advisor before investing

No comments:

Post a Comment